It has been a difficult decade for value investors. Once upon a time industry stalwarts like Benjamin Graham and Warren Buffet advocated value heavily but today it has taken a back seat. In the last decade, low global GDP growth, low inflation and low interest rates resulted in a liquidity crunch, which led to higher investment in a few growth-led industries.

Looking back, it is easy to observe that since the 2008 financial meltdown, growth investing has stolen a steady march over value investing which further intensified during the coronavirus pandemic. I believe the reason for the underperformance of ‘value’ cannot be simply explained by the outperformance of technology ‘growth’ stocks. Value stocks came under huge pressure as economic uncertainty prompted investors to shorten their time horizons and pile into sure winners. We have to acknowledge that the factors that helped the returns on value stocks earlier, no longer supported returns in the new macroeconomic and market environment.

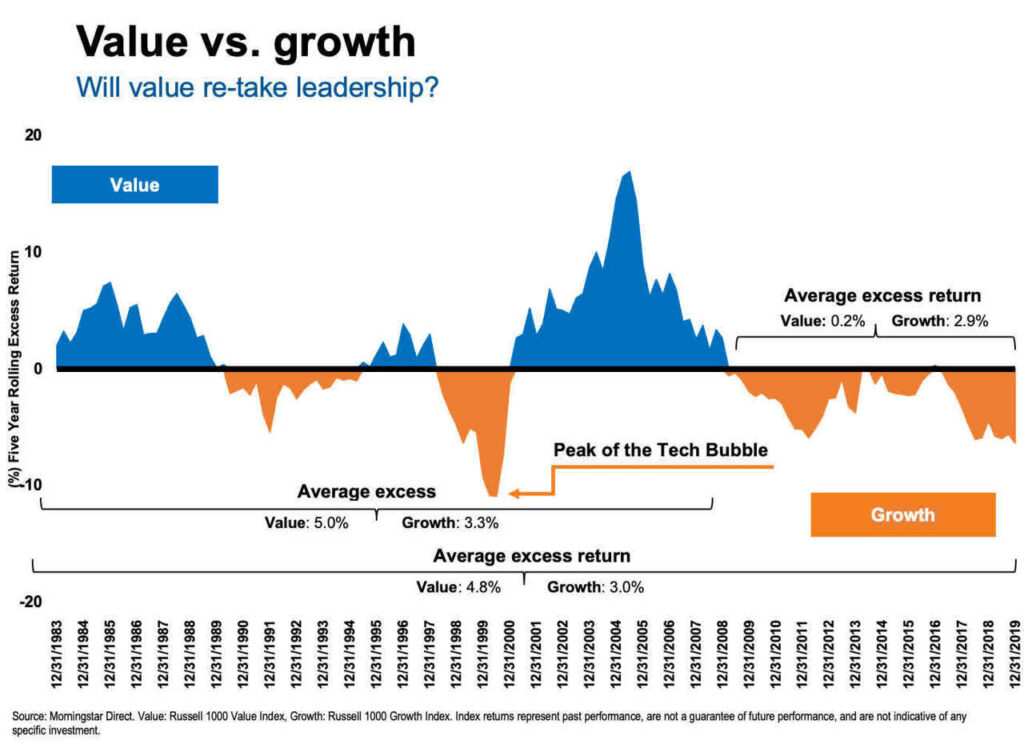

There is historical evidence of value investing outperforming growth investing. This chart by Russell Investments shows that post 2008 it has been the longest underperformance streak of Value to Growth over the last 40 years.

Against this backdrop many investors feel that the era of value investing has come to an end. But is it truly so? I am not sure! As per the above chart, average excess return of value is still 4.8% against 3% of growth. Post pandemic the dynamics are again changing and the environment is now looking more favorable for value investing. I foresee that the era of easy money is coming to a close and value investing may be due for a comeback in certain pockets like manufacturing and consumer industries.

Before we write off value, it’s important to take a fresh look at the fundamentals of value investing today and understand the scenarios that could favor value investing and help investors consider their allocations in the near future.

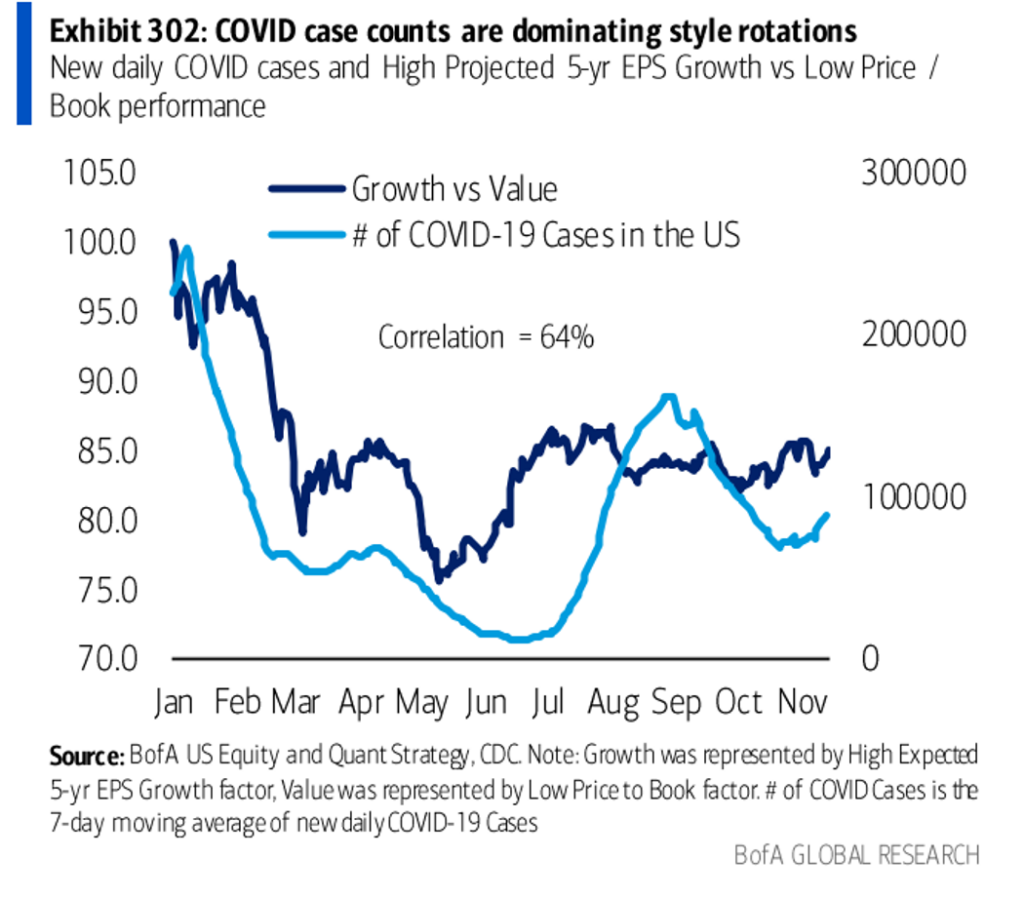

Firstly, post‑pandemic economic recovery is expected to drive cyclical stock performance. China is a great example of such recovery driven growth. By all accounts, China had much more success in suppressing the virus, and its economy is benefiting. Consumer spending, car sales, and economic growth have all bounced back strongly from the depths of the pandemic in early 2020. When Covid cases decline, the prospects for the economy improve, which suggests inflation and interest rates will rise. Similar pattern is also seen in the US as shown below.

In this chart from Bank of America for the US, the light-blue line is the Covid case count. The dark-blue line is the relative outperformance of growth to value. When the dark-blue line declines, it means value stocks are doing better than growth stocks. I am hopeful that similar pattern will continue with the world probably seeing the fag-end of the pandemic and receding omicron wave.

Secondly, the recent union budget prioritized fiscal spending to stimulate the economy with focus on infrastructure. I am gladly anticipating its positive impact on the rural economy and boost consumption. This would mean that the economic growth is expected to remain above its long-term trend. This higher GDP growth and expected normalization of fiscal policy by the RBI and US Fed in the coming months, would increase the liquidity in the market leading to a boost in value investing.

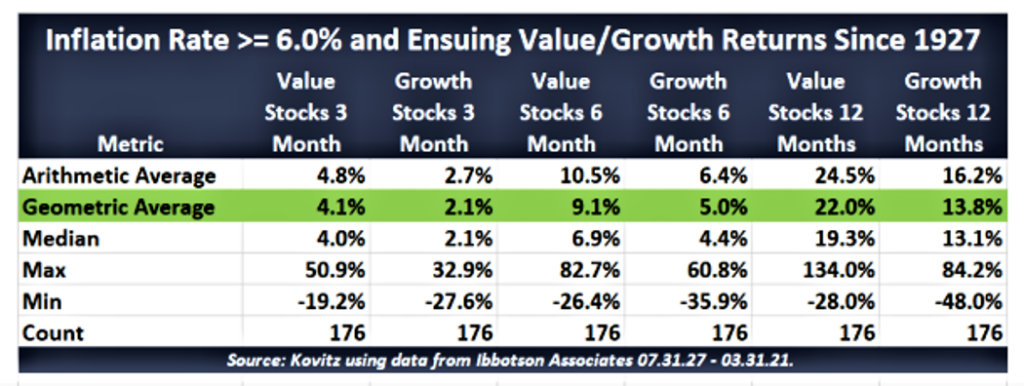

Thirdly, over the years I have observed that higher inflation is a positive for value strategies. When inflation rises, value companies have actual earnings and margins which they can improve by raising prices. Investors are aware of this and prefer to invest in such companies. In contrast, growth companies don’t have actual earnings and hence their margin comes under pressure.

The chart from Kovitz shows that value stocks historically outperform when inflation is high. I am foreseeing this trend to continue globally and expecting the value to pick up or even stay ahead of growth.

The investing style used in the last century is unsuitable to use in today’s tech-centric and fast-growing business world. In my opinion, no company would be worth investing based on the P/E alone. We can no longer apply 20th-century metrics in the 21st century, as they would not make much sense.

But the behavioural biases behind classic value investing haven’t really changed. The fear of loss still makes risk-averse investors sell poorly performing stocks heavily which in turn drive the prices much lower than deserved. Most value investors do not plan for too far into the future due to lower confidence in forecasts and magnified risks. Investors are prone to emotional biases and overreact under uncertainty.

To my way of thinking, the biases will continue to exist but investors need to realign themselves quickly in the rapidly changing world. I expect value investors to show patience over a sustained period of time and willing to take risk for long term growth.

To answer the question, has value investing become irrelevant, I would say an emphatic NO! Although many of the trends which drive growth outperformance may continue, value stocks also have potential to offer significant returns in current times. But we also need to consider what has changed in the world—and what hasn’t! We must refine a disciplined, stock-picking approach amidst the chaos of technology-driven industry disruption.

Where would you like to invest? Value or growth or build a portfolio carefully picking a mix of best of both?